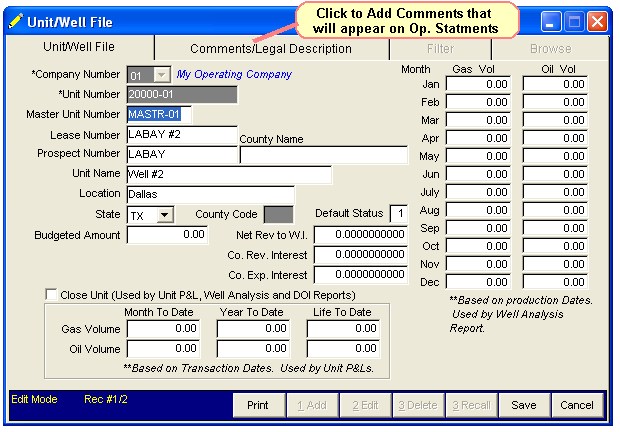

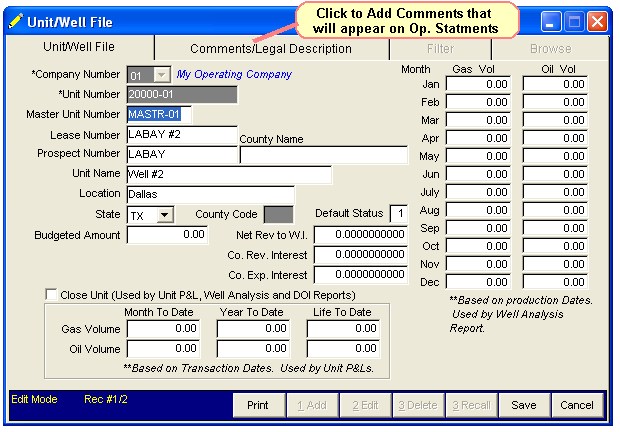

Unit/Well File

Select Master - Unit/Well

The Unit/Well file stores the unit, master unit, lease, and prospect number, name, location and state. This file also stores the unit’s gas and oil volume by month, year to date and life to date. The Unit/Well file is basically a well file. However, there are instances when you may want to track several wells as a group. That is why it is called the Unit/Well file instead of just a Well file.

Note: In order to display all records of a file, the Filter conditions must be blank, otherwise it will only list records that were contained in the previous filter.

Each New Unit Must Also Have:

1) A Unit Chart of Accounts in order to produce P & L's and Cost Reports on a Unit Basis.

2) A set of DOI Owners in order to allocate Revenue and Expenses to the Owners on this Well/Unit.

NOTES ON FIELDS

The unit number and master unit numbers must be 8 characters in length. We recommend the last 2 characters be the company numbers for easy identification when reports are printed (Ex: 20000-01 or LEBAY-02). If unit number needs to be changed in the future, you must go through Utilities, Data Tools then Key Code Change. Refer to Utilities section in Manual.

MASTER UNIT, LEASE, AND PROSPECT NUMBERS: This file has 4 levels, the unit, master unit, lease and prospect. The unit is the lowest entity and the prospect is the highest. In other words, a master unit can contain several units or wells, a lease can contain several master units and a prospect can contain several leases.

UNIT (Lowest Level - for example an individual well)

MASTER UNIT (2nd Level)

LEASE ( 3rd Level)

PROSPECT (Highest Level)

The purpose of having all these levels is so you can group several wells into one consolidated P & L. If no consolidation is required, you can assign the same number to the unit and the master. Leave the lease and prospect blank if no consolidation is required to a higher level. See the end of this section for an Example on Consolidating to Master Unit.

COUNTY NAME: Oklahoma is required to have the Unit’s County reported on some form of remittance to the Owners. If you enter the County name here it will then print on the Operating Statements. You will, however, have to set it up in Roughneck so it will print. To do so, go to File, Setup Options, Operating Statement Format and say Yes to “Include County and State after Unit Name”.

COUNTY CODE: Only the state of Oklahoma requires county codes for units. A separate 1099 miscellaneous Government Form is required for Investors who receive revenue from wells located in Oklahoma. See Oklahoma 1099 forms and Owner 1099 report for additional information. Information for this form is reflected on the Owner 1099 report.

DEFAULT STATUS: This is the DOI default status. Transactions entered for this well default to this DOI owner percentage level. The status of each transaction determines what owner percentage value from the DOI file is used to calculate the owners share of expenses, revenue and taxes. For example, if the default status of a unit = 3 (in the Unit/Well file), then the owner percentages listed for level 3 (in the Division of Interest file) will be used to calculate each owners share for transactions with status 3 to this unit.

BUDGETED AMOUNT: You may enter a total budget amount for this well. This amount is printed on the Well Cost report. Individual budget amounts may be established for each general ledger number in the Unit Chart of Accounts file for units.

Net Revenue to Working Interest: Put in the percentage of Revenue for Working Interest for this well. This will show up on your Well Analysis Report.

Company Revenue Interest: By putting in the Company Revenue Interest for this well, you can track the percentage on the Well Analysis Report.

Company Expense Interest: This field works the same as the Net Revenue to Working Interest and the Company Revenue Interest.

CLOSE UNIT: Check this box to prevent printing of a Unit P&L, Well Analysis and DOI report for this Unit. This can be used if a unit for that month or year has no production, taxes or expense. It will save time and paper when printing those reports.

MTD, YTD, and LTD GAS OR OIL VOLUME: These fields are updated when the period is closed. The transactions for general ledger numbers 3xxxx will be read for each unit that has either O/G type or oil or gas volume entered and will be updated to the fields for month to date, year to date, life to date gas/oil volume in the Unit/Well file. Production date, not transaction date and type 'O' for oil, 'G’ type for gas is used to update oil or gas volume to the applicable month in the Unit/Well file.

MTD GAS PRODUCTION, MTD OIL PRODUCTION: As oil or gas sales, general ledger numbers 30xxx-39xxx, are entered in the Transaction file or Run Check entry, you will be asked for the oil/gas production date. During a period close, the production volume for any transaction with a production date and type 'O' for oil or 'G' for gas will be stored in the Unit/Well file to the corresponding month for that production date. If you have a transaction with a transaction date of 9/30/2004 and a production date of 08/30/2004, the volume will be stored in the month of August in the Unit/Well file.

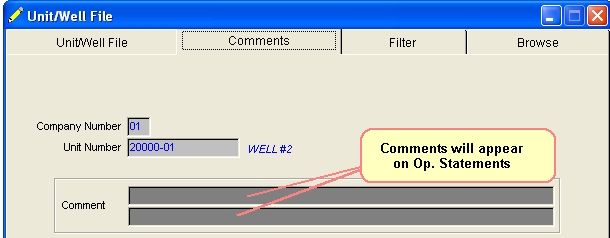

COMMENT: You may enter 2 lines of comments for each unit in the Unit/Well file to print on the Operating Statements. Comments also may be entered in the JIB program on your tool bar, under Tools for Statements, Comments for Statements.

EXAMPLE OF CONSOLIDATING TO MASTER UNIT

Assume you have a 3 well project, and expenses can be tracked by each well but the revenue from each cannot be tracked separately since they all empty into the same tank. In this instance, you should set up 4 units, (3 wells and 1 revenue unit) and give them all the same master unit number. This enables you to obtain a Consolidated P & L of the 3 wells for the master unit 10000-01.

Example for a project of company 01, a 3 well project that has only 1 revenue tank.

Master

Unit No. Unit No.

Rev. Unit for all 3 wells 10000-01 10000-01

First Well 10001-01 10000-01

Second Well 10002-01 10000-01

Third Well 10003-01 10000-01

In the previous example, when entering revenue and the system asks for a unit number enter 10000-01. When entering expenses for well number 1 use 10001-01, for well 2 expenses use 10002-01, and for well 3 expenses use 10003-01. This numbering scheme gives you the ability to obtain a consolidated P & L for all 3 wells, when you ask for master unit 10000-01. If no further consolidation is required, you will leave the lease and prospect number blank. This will avoid having the same totals printed on Unit P & L statements for lease and prospect as the master unit.

Related Topics

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.